Are you planning to start a business in Croatia, but worried that online company formation might take too much time? House of Companies offers urgent company formation services. For those in a hurry or needing a company with history, we provide Shelf Companies and same-day formation services!

Looking to expand into Croatia by purchasing a readymade company? Expanding can be complex and costly, but our Entity Management has you covered! Croatia, along with most European countries, allows you to register your current legal entity as a branch.

Try our Entity Management to register your branch or start your company with a Free Trial. Once your local branch is registered, you can use Entity Management to further run and grow your company!

Entrepreneurs can choose from several structures when expanding or starting a business in Croatia:

Croatian Company (SE): Operating under a unified set of rules, the Societas Europaea (SE) allows businesses to operate across multiple EU countries without the need to establish separate legal entities in each nation. This structure is ideal for companies aiming for a broad European presence.

Croatian Cooperative Society (SCE): Combining elements of a cooperative and a public limited company, the SCE offers flexibility in terms of location, as the registered office can be moved across EU countries without the need for dissolution or re-establishment.

Croatian Economic Interest Grouping (EEIG): Designed to facilitate economic collaboration, the EEIG allows entities to pool resources and expertise to enhance their economic activities. It’s important to note that profit generation should not be the primary objective of an EEIG.

However, in practice, these EU entities are rarely used, especially not by SMEs that want to enter the EU market. Most SMEs opt for the registration of a Local Entity, or the so-called Branch Registration.

Some countries enable business registration in as little as three working days, with costs kept below EUR 100, and all procedures manageable through a single administrative body. Many countries now allow online registration, making it easier for businesses to comply with registration requirements without physical presence.

Germany boasts the largest economy in Europe, making it a prime location for startups and business expansions. Its strong economy, skilled workforce, and the start-up hub of Berlin provide robust opportunities for growth, particularly in tech and innovation sectors.

Ireland offers enticing incentives such as a low corporate tax rate of 12.5% and access to a young, well-educated workforce. The country has become a hub for major tech companies like Google and Apple, thanks to its supportive policies and vibrant venture capital ecosystem.

The Netherlands presents a compelling case for business setup with its excellent infrastructure, high English proficiency, and favorable tax conditions. The Dutch branch model, in particular, is highlighted for its minimal accounting formalities, manageable through the House of Companies dashboard at a fixed fee of EUR 1,000, making it a standout choice for entrepreneurs seeking simplicity and cost-effectiveness.

Lithuania and other Baltic states like Estonia and Latvia are attractive due to their low corporate tax rates and living costs, which maximize entrepreneurial budgets and investment opportunities.

Portugal and Spain not only offer rich historical trade routes but also modern entrepreneurial visas and programs that support new businesses, making them especially appealing for startups looking to tap into the European and North American markets.

France is rapidly becoming a center for tech startups, supported by a network of tech hubs and startup campuses across the country, bolstered by state and EU investment. However, the taxes in France are quite high, and the formation process can be quite complicated.

In Western Europe, The Netherlands and Germany are typically considered the top candidates for companies planning to enter the EU market.

Company formation in Croatia involves the process of incorporation, where a business entity is formally created and registered with the relevant authorities. This process establishes the legal existence of the company, allowing it to conduct business activities in the country.

To establish a new company or expand your business in Croatia, it is essential to navigate the regulatory environment efficiently. Croatia, like other EU member states, offers distinct advantages and challenges, making it crucial to understand the specific processes for company formation.

The first step in registering a business in Croatia involves understanding local laws and regulations. Entrepreneurs should start by consulting national contact points, which provide detailed guidance on setting up a company. These points are crucial in understanding the nuances of local business laws and can be accessed online.

The EU has set targets to streamline the registration process:

Choosing the right country and company type is pivotal, as each has its legal frameworks and tax implications that affect the business.

Once the appropriate country and business type are selected, the next steps involve completing the registration process. Croatia offers online portals where businesses can register, simplifying the process significantly. Entrepreneurs should prepare the necessary documentation, which may vary by business type, and submit their applications through these portals.

Obtaining the necessary licenses and permits is also crucial and depends on the specific industry. Entrepreneurs should ensure they are well-prepared with all required documents to avoid delays.

Finally, preparing to start operations is essential. This includes setting up a business bank account, establishing a payment system, and taking steps to protect intellectual property. These actions ensure that once the registration process is complete, the business can operate smoothly and comply with local regulations.

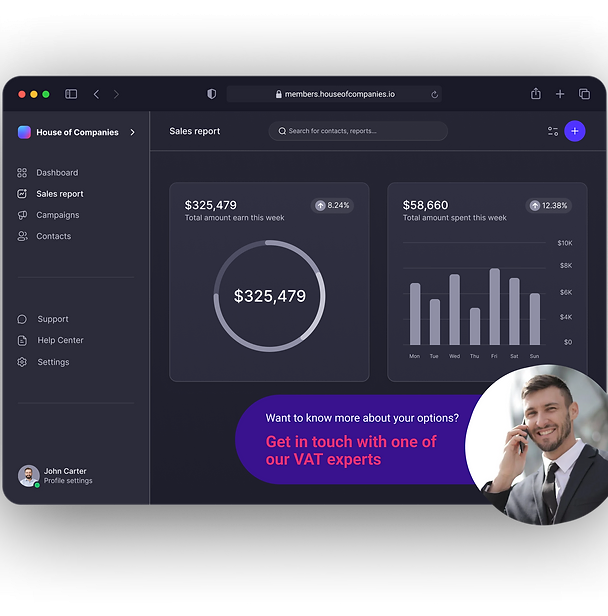

By following these structured steps and utilizing resources like the House of Companies dashboard for managing financial tasks efficiently, entrepreneurs can navigate the complexities of Croatian business registration with confidence and establish a compliant and successful business.

Legal compliance and obtaining sound legal advice can be a significant challenge, especially for startups and small businesses operating on tight budgets. Innovations in legal technology have begun addressing these challenges by democratizing access to legal services, making them more affordable and accessible.

Several platforms have emerged to bridge the gap in legal services, providing affordable and understandable legal advice. For example, Rocket Lawyer Europe offers free legal information in plain language, real-time consultations, and discounted legal fees through a network of lawyers.

Similarly, platforms like Hugo.legal in Estonia and Pocket Law in Sweden provide access to legal advice and documentation at a fraction of the traditional cost. These services not only reduce expenses but also simplify the legal process for business owners.

Entrepreneurs should consider leveraging these platforms to handle routine legal tasks such as creating contracts, managing intellectual property rights, and ensuring compliance with local regulations. By using technology-driven solutions, businesses can save on legal fees and redirect their resources towards growth and development.

For those looking to further minimize costs, the DIY legal route offers an alternative. Tools like Rocket Lawyer’s Q&A platform enable users to generate customized legal documents by simply answering a series of questions. These documents can then be reviewed and signed electronically, providing a cost-effective solution for basic legal needs.

Moreover, understanding and preparing statutory documents, such as the company's articles of association and memorandum of association, is crucial. These documents must comply with the specific laws of Croatia where the business operates. Entrepreneurs can access a plethora of online resources and government portals that provide guidelines and templates for these documents, helping to ensure compliance without the need for expensive legal consultations.

By embracing these innovative solutions and platforms, entrepreneurs can navigate the legal landscape of Croatia more effectively, ensuring compliance while managing costs.

To significantly reduce operational costs, companies should consider the size and necessity of their physical office spaces. For instance, downsizing to a smaller office or utilizing residential spaces for business operations can offer substantial savings compared to traditional commercial properties. This approach is particularly beneficial for small businesses like notary offices or beauty salons located in residential areas, providing both affordability and convenience.

Moreover, embracing remote work can further slash expenses. By allowing employees to work from home, businesses can save on workplace costs and commuting expenses. Implementing regular team meetings in co-working spaces coupled with robust remote work programs can maintain team cohesion without the constant overhead of a full office space. However, it is crucial to set clear KPIs to ensure productivity and accountability in a remote setting.

Outsourcing is another effective strategy to optimize staff costs. Instead of maintaining in-house departments for logistics, legal, or accounting, companies can engage external specialists on a project basis. This not only reduces staffing and training expenses but also aligns costs directly with specific business needs and scales.

Adopting emerging technologies can provide a competitive edge while enhancing cost-effectiveness. Cloud-based solutions, for example, offer scalable access to advanced IT resources without the hefty price tag associated with major infrastructure investments. These technologies enable virtual workspaces and remote collaboration, reducing the need for physical office space.

Automation plays a critical role in reducing labor costs by handling repetitive tasks such as back-office operations. This not only frees up employee time but also minimizes human error, leading to more streamlined business processes.

Furthermore, digital accounting tools provide real-time visibility over financials, allowing businesses to track income, expenses, and taxes efficiently. This aids in better cash flow management and enables companies to make informed, data-driven decisions that support sustainable growth.

By integrating these strategies, startups can become more agile, reduce operational costs, and invest resources into expanding their business reach. Additionally, the Dutch branch model, managed through the House of Companies dashboard at a fixed fee, exemplifies how minimal accounting formalities can further streamline operations and reduce costs for businesses looking to establish or expand their presence in Europe.

Technology is a powerful tool for cost reduction, enabling Delaware businesses to optimize various processes through digital transformation.

By implementing cloud-based solutions, digital accounting, and automated systems, companies can minimize time-intensive manual tasks, reduce error rates, and lower the need for extensive in-house support.

Automation and digital platforms not only reduce operational costs but also enhance scalability, allowing businesses to adapt to growth demands efficiently while maintaining manageable overhead. This technology-driven approach supports Delaware’s reputation as a low-overhead business hub and frees up resources to reinvest in core activities.

Forming a private limited company in Croatia requires specific documentation and fulfilling certain statutory requirements. These may include the memorandum and articles of association, details of company directors and shareholders, and the registered office address.

Dealing with a local notary and deposit requirements can be a hassle. I registered my UK LTD in Croatia with the help of Entity Management.

Trucking & Logistics

Trucking & LogisticsI didn’t really want to start a local business—it was so confusing. But I needed a local company number. The branch works great!

Bol.com Trader

Bol.com TraderThe outsourcing of staff required us to register in Germany. Entity Management is a perfect fit for us!

Recruitment & Payrolling

Recruitment & PayrollingRegistering a branch of your existing Limited Company might not be the best option for you. In our blogs and roadmaps, we explain the pros and cons in more detail for each country.

If you decide to incorporate a local company, House of Companies can assist you with the incorporation.

Learn More →

Learn More →

Learn More →

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!